Castelo de Sonhos Gold Project

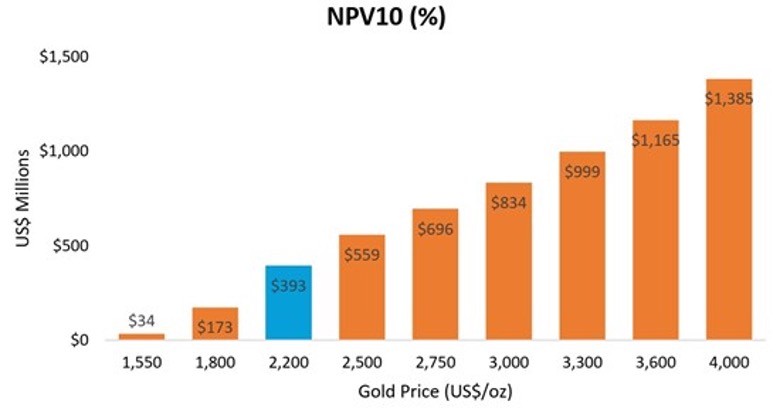

In May 2025, TriStar announced the results of an updated PFS for Castelo de Sonhos, incorporating the latest in cost estimates, gold prices and exchange rates.

The 2025 Updated PFS outlined an open pit operation with strong economics at US$2,200 per oz. base-case gold with strong leverage to an increasing gold price. The project scope, resources and reserves remain unchanged from the 2021 PFS.

- After-tax NPV5% of US$1,353 million at spot gold of approx. US$3,200 per oz. at the time of release

- After-tax NPV5% of US$603 million at US$2,200 base-case gold.

- Compelling after-tax IRR of 72% at US$3,200 gold and 40% at US$2,200 base case gold price.

- Life of mine gold reserves of 1.4Moz

- LOM average production of 121koz per year in two phases

- AISC of $1,111 per oz

- After-tax payback period of 2 years

- Initial capital of US$296M – incl. 20% contingency